Product-Led Growth Companies Find a New Way to Serve Customers

Companies from Zoom to Slack lean on the product itself to find customers, convert them to paying, and drive rapid growth in revenues and services — without adding more staff.

Topics

Not so long ago, companies of all types gave most of their attention to the human tasks performed in interfacing with customers. They focused carefully on processes like providing recommendations, taking orders seamlessly, and cross-selling and upselling.

Today, however, many software companies are embedding these processes in software, relying as little as possible on human customer contact for their sales, marketing, and service functions. These cloud-based organizations count on software capabilities alone to meet customer needs, and they strive for rapid expansion without adding customer-facing staff members.

Called product-led growth, or PLG (a term attributed to venture capital firm OpenView, which has used it since 2016), this business model includes these key attributes:

- Free or very low-cost introductory pricing, with higher prices for more functionality (like what’s offered by communications tool Slack).

- A product that is desirable or useful enough to be widely shared (like the calendar tool Calendly, which has grown by being shared by users looking to collaborate with colleagues and friends).

- Ease of use of product features, conversion activities, payment, and other services (like what users have found with video communications platform Zoom).

While many PLG companies come from the software industry, it’s not just a software strategy: Aspects of the ethos behind this growth model are spreading to other businesses that rely in part on customer-facing software.

A Shining Example of PLG: Zoom

One excellent example of a PLG product with highly successful growth is Zoom. It offers free subscriptions for individuals, levels of paid membership for businesses, and high ease of use compared with previous generations of such tools.

Zoom’s software was launched in 2013 and had 40 million users by 2017. During the pandemic, of course, usage grew much more rapidly — from 10 million daily meeting participants in 2019 to 300 million in April 2020. Its profits went from $7 million in 2018 to just over $1 billion in 2021. Zoom had some stumbles in terms of data privacy issues and hacker “Zoom bombing,” but it has largely overcome them and added more use cases and capabilities.

One Zoom customer comment (posted on the company’s website) from a technology director at Nasdaq summarizes the product’s critical ease of use: “I never get asked about how to use Zoom — people just get accounts and I never hear from them again, all I see is the usage on the dashboard go up continuously.” In other words, the product is simple to acquire and learn. Their lack of support requirements means that PLG products make life easier for the IT staffs within customer organizations.

Zoom also provides examples of other key PLG features: the blurring of the distinction between consumer and corporate customers (whereas most PLG companies have both, with a smooth transition from individual user to corporate accounts); a focus on allowing end users to acquire the tool (rather than selling the product by business function or unit head buyers, or by IT functions); use of the cloud to provide computing and storage capabilities for rapid growth; and continuous experimentation and analysis of data on user behavior for product improvement.

What Makes Product-Led Growth Work

Product and experience design are critical aspects of a successful PLG offering. They are the replacement for the process design activities that previously took place in business process improvement and reengineering programs. Not only must a program’s basic functionality be sound and inviting to users, but key customer-facing activities must be accomplished with ease as well. (See “How to Make Product-Led Growth Work.”)

How to Make Product-Led Growth Work

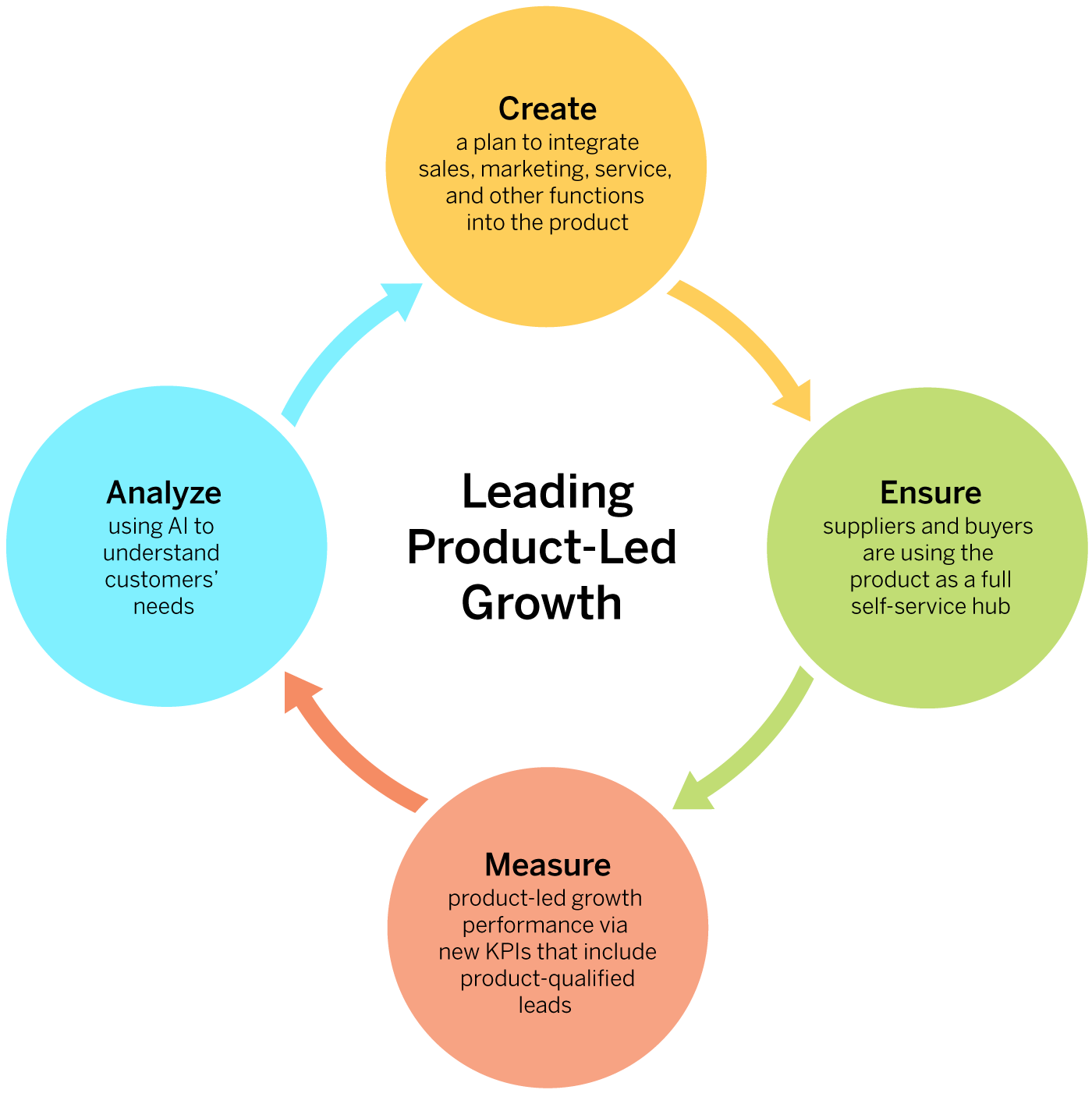

Today’s most valuable companies are product-led platforms. To achieve a transition from growth that is sales and marketing led to product led, leaders must implement a four-step program that builds sales, marketing, and support processes into the product via engineering.

The following are some of the lessons learned from successful PLG strategies.

Product development approaches need to be lean (so that early customers can evaluate minimum viable products) and agile (to engage stakeholders and provide frequent deliverables). Successful organizations develop criteria to measure the ease of customer interaction with key functions. Rules of thumb include having a certain level of Net Promoter Score, low measured latency for certain transactions, and a small number of clicks to accomplish specific functions (some call it “a three-click journey to value,” although there is no hard evidence supporting that number).

Because PLG offerings need to grow over time, there is usually a need for continued evolution of the product. Companies must plan for the addition of functionality over time. Zoom, for example, has added webinars, support for conferencing room technology from other vendors, breakout rooms, virtual backgrounds, and multiple other features over its short history. Some customer-facing capabilities at PLG businesses might begin as human-performed and later be incorporated into software as usage grows.

PLG offerings reduce the cost of growth by creating their own qualified leads. These are the potential paying customers who are already using the free version of the product. This is miles from the process for traditional leads, where potential customers need to demo the product, often with help from a human salesperson. Leads are also generated by word of mouth from satisfied customers rather than only from the organization’s marketing function.

Personnel are distributed differently in companies built around PLG. Because service is primarily through content and intelligence embedded in the product rather than through a human-staffed help desk, the ratio of product engineering staff members to sales, marketing, and service people in PLG companies is substantially higher than in traditional software companies. Zoom, for instance, began its customer service with traditional trouble tickets addressed by humans, but many issues are now addressed via a chatbot. PLG companies such as Zoom that also have large corporate customers often still maintain a sales force to interface with them.

The Important Role of Data, Analytics, and AI for PLG

A key aspect of PLG is gathering and analyzing data about product usage and customer behavior. Product usage drives upgrades, pricing, feature availability, and, of course, growth. It must be analyzed carefully. In addition, companies need to address any problem areas in product usage and the user experience. Session cams and heat maps, for instance, can be used to see when a session is dropped. More sophisticated analytics and machine learning applications can be used to identify the predictors of churn and low customer satisfaction. A/B testing can show which product features and user experiences appeal most to customers.

Since their aim is rapid growth without similar growth in employees, PLG companies benefit from using artificial intelligence for customer support tasks like onboarding, help desk services, and product recommendations. While AI may not yet be as capable as human support for some of these functions, it can take the burden off of employees for the more straightforward tasks.

AI is also increasingly important for adding capabilities to products. Most PLG offerings are aimed at knowledge workers, so they need to have intelligence that aids these types of customers in doing their jobs. Many PLG companies have added AI capabilities:

- Otter.AI uses AI for natural language transcription.

- Grammarly has AI-enabled writing improvement for memos, social posts, and emails.

- X.ai provides AI-assisted meeting scheduling.

- Asana folds AI-assisted project and product management into its offerings, including time monitoring and workflow automation.

- Forethought uses AI for customer service teams.

- Slack has added AI to its communications capabilities to identify the most important messages for its users.

- Zoom uses AI to identify videoconference highlights, create transcriptions, and provide recommendations for sales teams after Zoom-based meetings.

Can PLG Extend Beyond Software Companies?

Perhaps the most important common attribute of successful PLG companies is improved valuation and financial performance. This results from faster growth and lower costs for customer-facing processes. OpenView calculated in 2020 that PLG companies represented more than half of recent initial public offerings, with the median valuation of public PLG companies double that of the broader index of public software-as-a-service companies ($6.8 billion versus $3.4 billion).

This raises an obvious question: As PLG becomes firmly established in the software industry, can it be extended to other types of businesses that interact with customers over software?

To a large degree, it already has been because increasing numbers of companies rely heavily on software and have observed the growth of PLG businesses. Platform or e-commerce companies whose primary offering is something other than software — for example, ride-sharing companies Uber and Lyft, rental property marketplace Airbnb, the Amazon markets and Shopify sales platforms, and payment transaction apps Stripe and Plaid — have many attributes of PLG companies, including transparent pricing and free or trial services. They also make considerable use of data, analytics, and AI in their businesses.

Given the growth and margins of PLG companies, it seems likely that many companies in which software is a possible channel to customers will embrace this approach. Just as not all PLG companies succeed — there is “survivor bias” in describing the companies that have grown rapidly using this approach — not all non-software companies are well suited to the model either. Their products have to be appealing both to individual consumers as well as businesses, and they have to develop offerings of obvious value to those customers. Then they can begin to strategize about how to incorporate customer-facing processes into software.

At the very least, though, PLG businesses should provoke traditional companies into thinking about new ways to sell to and serve customers with a blend of human and digital capabilities.